New York

Taxation

In terms of combined state and local taxes as a percent of income, New York, at 12.2% in 2003, is 2nd only to Maine in the US. Personal income tax is the state's largest source of revenue. The five-bracket personal income tax schedule ranges from 4% to 6.85%. The basic corporate tax is 9% on net income, but only 6.85% for businesses with net income under $200,000. Effective 1 June 2003, New York's general sales tax rate was raised to 4.5% from 4%. Local governments impose additional sales taxes ranging from none to 4.25%. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages, amusements, parimutuels, and other selected items. In 2002 New York increased both its gas tax (from 8 cents a gallon to 32.35 cents a gallon) and its cigarette tax (from $1.11 to $1.50 a pack). There is no inheritance tax and New York's estate tax is tied to the federal tax exemption for state death taxes. In 2002, death and gift taxes accounted for 1.8% of total state taxes collected. Other state taxes include license fees and stamp taxes. There are no state property taxes, which are all collected locally. The state collects less than half (45.6% in 2000) of total non-federal taxes paid in New York.

The state collected $19.158 billion in taxes in 2002, of which 59.1% came from individual income taxes, 19.9% came from the general sales tax, 10.4% from selective sales taxes, 5.2% from corporate income taxes, and 2.4% from license fees.

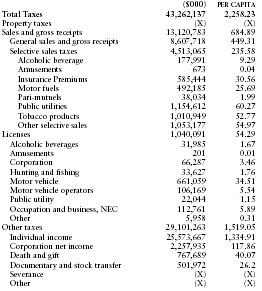

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 43,262,137 | 2,258.23 |

| Property taxes | (X) | (X) |

| Sales and gross receipts | 13,120,783 | 684.89 |

| General sales and gross receipts | 8,607,718 | 449.31 |

| Selective sales taxes | 4,513,065 | 235.58 |

| Alcoholic beverage | 177,991 | 9.29 |

| Amusements | 673 | 0.04 |

| Insurance Premiums | 585,444 | 30.56 |

| Motor fuels | 492,185 | 25.69 |

| Pari-mutuels | 38,034 | 1.99 |

| Public utilities | 1,154,612 | 60.27 |

| Tobacco products | 1,010,949 | 52.77 |

| Other selective sales | 1,053,177 | 54.97 |

| Licenses | 1,040,091 | 54.29 |

| Alcoholic beverages | 31,985 | 1.67 |

| Amusements | 201 | 0.01 |

| Corporation | 66,287 | 3.46 |

| Hunting and fishing | 33,627 | 1.76 |

| Motor vehicle | 661,059 | 34.51 |

| Motor vehicle operators | 106,169 | 5.54 |

| Public utility | 22,044 | 1.15 |

| Occupation and business, NEC | 112,761 | 5.89 |

| Other | 5,958 | 0.31 |

| Other taxes | 29,101,263 | 1,519.05 |

| Individual income | 25,573,667 | 1,334.91 |

| Corporation net income | 2,257,935 | 117.86 |

| Death and gift | 767,689 | 40.07 |

| Documentary and stock transfer | 501,972 | 26.2 |

| Severance | (X) | (X) |

| Other | (X) | (X) |