Quote:

Originally Posted by BigHouse9

Baaa-baaaa-baaaaaahhhhh!! Typical sheep.

Tax revenues increased after a tax cut. Democrats just hate this, but increased revenues are the norm after tax cuts. Why? Because tax cuts spur economic growth. The CBO said that the Bush tax cuts would lower 2006 revenues by $75 billion. Oops! Wrong again! Revenues actually increased by $47 billion.

|

I'd hate to break it to you how far off the facts you are.

You main fallacy is that the Bush tax-cuts increased revenue. There is no empirical evidence that the claim is true and plenty of evidence that the claim is false.

Not even Mitch McConnell makes that claim. McConnell said, there is

"No evidence whatsoever that the Bush tax cuts actually diminished revenue." He wasn't saying it increased it; he said it didn't diminish it. But even that's wrong.

George W. Bush's CEA chair, Greg Mankiw, who used the term

"charlatans and cranks" for people who believed that "broad-based income tax cuts would have such large supply-side effects that the tax cuts would raise tax revenue." He continued:

"I did not find such a claim credible, based on the available evidence. I never have, and I still don't."

The bottom-line is that the Bush tax-cuts cut revenue: In 2000, federal tax revenues were $2,025.46 billion, nominal GDP was $9,951.5 billion. In 2003, these amounts were $1,782.53 billion and $11,142.1 billion. In other words,

GDP rose 12% and federal revenues fell 12%.

Federal revenues eventually rose, to take out the 2000 peak in 2005 (2007 in real terms,) but this doesn't mean much. Revenues eventually catch up due to GDP growth and population growth regardless of policy. The economy grows 4-6% most years, unadjusted for inflation, so naturally the general trend of taxes is to rise about 4-6% each year. Being unable to return to a previous peak for five years, despite this built in trend strongly suggests tax cuts reduced revenue, ceteris parabus.

Looking at it graphically

we see that after each of the Bush tax-cuts, revenue dropped. How anyone can deny this and claim that the tax-cuts increased revenues is astounding. In mid-2003, federal revenue was lower than in 1999:

Quote:

Originally Posted by BigHouse9

What about jobs? In the 18 months before the Bush tax cuts our economy lost 267,000 jobs. In the 18 months following the cuts it added over 300,000 jobs. In the next 19 months another 5 million jobs were added.

|

What you tout as remarkable performance on jobs during the Bush years is actually dismal performance.

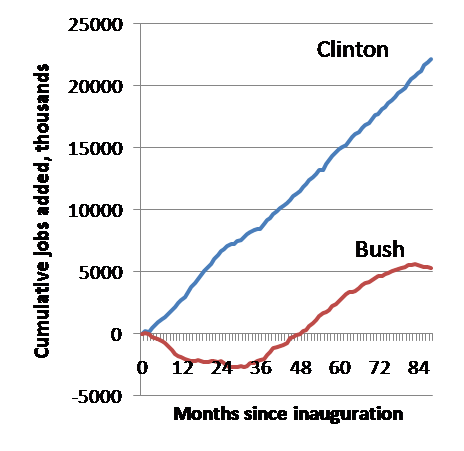

Clinton's employment record, with higher taxes, far out-achieves Bush's.

In eight years, Bush's gains were 5 million, or an average of 52,000 per month. The number of job gains needed to handle increases in population is 150,000 per month (

citation). Clinton, who raised taxes, in 8-years added 22 million jobs. Apart from a stellar performance, Bush's job performance was dismal. Thus, the theory, such as it is, that lower taxes spur job creation sure isn't confirmed from your example.

This is the unemployment rate and civilian employment during Bush's term, 1/2001-1/2009: