Supply/Demand and trying to Predict the Real Estate Market

Orange and Seminole County Market

There are a myriad number of different factors that people claim steers the real estate market. Some of the factors I have heard of are area incomes not keeping pace with housing, rent to housing cost ratios, foreclosures, sub prime loans, media scare tactics, over building, overpricing, unrealistic sellers, unrealistic buyers, unemployment rate, the overall economy, and the list goes on and on. While all of these factors are valid in one way or another, they all go back to the simplest of economic theories that drives ALL of today’s markets, supply and demand.

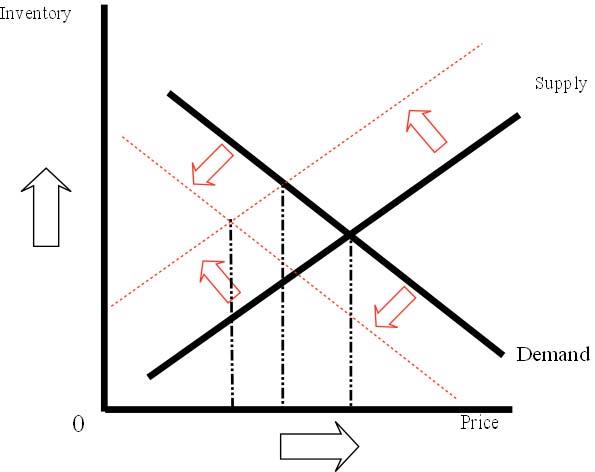

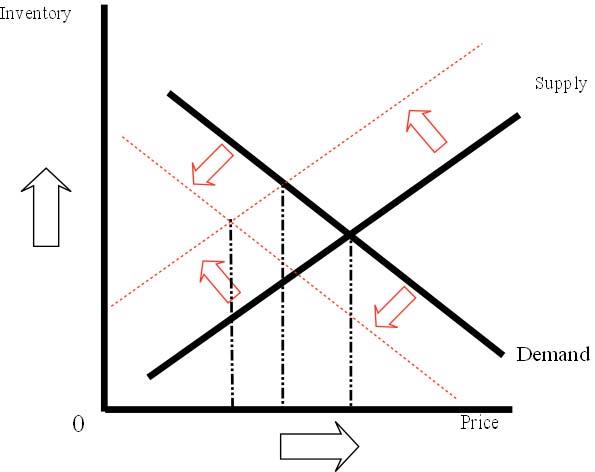

The law of supply and demand states prices are pressured toward an equilibrium point, where the supply line and demand line meet, illustrated below.

Simply put: An increase in supply causes a decrease in price.

A decrease in demand causes a decrease in price

An increase in demand causes an increase in price

A decrease in supply causes an increase in price

As of the end of November 2007, there were a little over 26,000 homes for sale in the Orlando market of Orange and Seminole Counties. In the same month there were only 963 properties that sold Down from an average of 1,636 homes sold per month between November 2006 and August 2007; illustrating the sharp drop in demand most likely caused by the implosion of the sub prime mortgage market in September 2007. There is currently a 27 month supply of homes.

To put these numbers in perspective, the monthly inventory between Oct. 2002 to Oct. 2003 was always between 7,000 to 8,000 properties with an average of 1,860 properties selling per month, representing a market in equilibrium with a 4.3 month supply of homes.

Doing the math, if there are zero net additional homes that come onto the market (supply freezes), and demand for homes comes back to a normal rate of about 1,700 homes selling per month, it will take 10.5 months to sell off the excess home inventory down to a normal 8,000 units. Once this occurs, historical equilibrium will be reached and prices will stop being pressured downward.

Given the normal reasons for the rise in property supply; job relocations, growing or shrinking families, divorce, foreclosure, etc, more homes coming on the market should be expected. And while I personally believe the demand for homes must eventually come back to normal levels, there are still many buyers hesitant about buying in this market. Demand may remain at a low of only 1,000 units selling a month for the foreseeable future. These factors could mean prices will be pressured downward for some time, perhaps closer to 18-24 months.

All that being said the real estate market is extremely local in nature, sometimes down to a particular neighborhood or even particular home. Some areas have a different supply than others, and some have different demand. There are always areas that are more desirable than others, and at different price points sellers tend to be able to hold out longer for the price they set. This explains why some areas like Winter Park have seen very little if any depreciation since 2005, while others have dropped in value as much as 30%!

Only a local market evaluation, factoring your specific needs and time frames, can determine whether selling your home, or buying your next home, makes sense in today’s changing market.

You must ask yourself and your realtor some questions before making an educated, thought out decision……

Should you Sell today or wait until the market gets better?

What is your motivation for selling?

How long can you really “wait it out”?

Will your home be worth more or less in 2,3,4,5 years?

Should you buy today, or wait for homes to come down more in price?

How long do you plan to live in the home?

How much of your quality of life depends on the ownership of a home?

How much will it cost you to rent vs. buy?

How much do you value stability; not having to move when landlords decide to no longer rent?

Can you comfortably afford your dream home today?

Will Interest Rates go up in the future making my payment less affordable?

Will the perfect home you find today, still be available tomorrow?

For the most recent market stats to see where the market is today, go to Useful information and articles I have written to help you the consumer.

There are a myriad number of different factors that people claim steers the real estate market. Some of the factors I have heard of are area incomes not keeping pace with housing, rent to housing cost ratios, foreclosures, sub prime loans, media scare tactics, over building, overpricing, unrealistic sellers, unrealistic buyers, unemployment rate, the overall economy, and the list goes on and on. While all of these factors are valid in one way or another, they all go back to the simplest of economic theories that drives ALL of today’s markets, supply and demand.

The law of supply and demand states prices are pressured toward an equilibrium point, where the supply line and demand line meet, illustrated below.

Simply put: An increase in supply causes a decrease in price.

A decrease in demand causes a decrease in price

An increase in demand causes an increase in price

A decrease in supply causes an increase in price

As of the end of November 2007, there were a little over 26,000 homes for sale in the Orlando market of Orange and Seminole Counties. In the same month there were only 963 properties that sold Down from an average of 1,636 homes sold per month between November 2006 and August 2007; illustrating the sharp drop in demand most likely caused by the implosion of the sub prime mortgage market in September 2007. There is currently a 27 month supply of homes.

To put these numbers in perspective, the monthly inventory between Oct. 2002 to Oct. 2003 was always between 7,000 to 8,000 properties with an average of 1,860 properties selling per month, representing a market in equilibrium with a 4.3 month supply of homes.

Doing the math, if there are zero net additional homes that come onto the market (supply freezes), and demand for homes comes back to a normal rate of about 1,700 homes selling per month, it will take 10.5 months to sell off the excess home inventory down to a normal 8,000 units. Once this occurs, historical equilibrium will be reached and prices will stop being pressured downward.

Given the normal reasons for the rise in property supply; job relocations, growing or shrinking families, divorce, foreclosure, etc, more homes coming on the market should be expected. And while I personally believe the demand for homes must eventually come back to normal levels, there are still many buyers hesitant about buying in this market. Demand may remain at a low of only 1,000 units selling a month for the foreseeable future. These factors could mean prices will be pressured downward for some time, perhaps closer to 18-24 months.

All that being said the real estate market is extremely local in nature, sometimes down to a particular neighborhood or even particular home. Some areas have a different supply than others, and some have different demand. There are always areas that are more desirable than others, and at different price points sellers tend to be able to hold out longer for the price they set. This explains why some areas like Winter Park have seen very little if any depreciation since 2005, while others have dropped in value as much as 30%!

Only a local market evaluation, factoring your specific needs and time frames, can determine whether selling your home, or buying your next home, makes sense in today’s changing market.

You must ask yourself and your realtor some questions before making an educated, thought out decision……

Should you Sell today or wait until the market gets better?

What is your motivation for selling?

How long can you really “wait it out”?

Will your home be worth more or less in 2,3,4,5 years?

Should you buy today, or wait for homes to come down more in price?

How long do you plan to live in the home?

How much of your quality of life depends on the ownership of a home?

How much will it cost you to rent vs. buy?

How much do you value stability; not having to move when landlords decide to no longer rent?

Can you comfortably afford your dream home today?

Will Interest Rates go up in the future making my payment less affordable?

Will the perfect home you find today, still be available tomorrow?

For the most recent market stats to see where the market is today, go to Useful information and articles I have written to help you the consumer.

Total Comments 1

Comments

-

Nice post. Thanks for explaining Econ 101. Something I wished I paid a little more attention to in college.

Nice post. Thanks for explaining Econ 101. Something I wished I paid a little more attention to in college.

Posted 07-31-2008 at 09:23 PM by sheenie2000