Arizona

Taxation

Approximately half (50.6% in 2002) of state tax revenues are raised by the Arizona's general sales tax, and approximately a quarter (24.6% in 2002) by the state's personal income tax. The state general sales tax rate is 5.6% (with exemptions for food and prescription drugs), and localities can impose up to 3% additional sales tax producing a maximum 8.6%. The personal income tax has five brackets ranging from 2.87% (up to $10,000 taxable income) to 5% (above $150,000). Selective income taxes (excises) accounted for 12.6% of state tax collections in 2002, and cover motor fuels, tobacco products, insurance premiums, alcoholic beverages, public utilities, pari-mutuels, and amusements. Arizona's corporate income tax is a flat 6.968% on net income, and in 2002 accounted for 4% of state tax collections. Various license and franchise fees accounted for 3.2% of state collections in 2002, and death and gift taxes, a little less than 1%. In 2003, Arizona ranked 14th among the states in total state and local tax burden, which amounted to 9.9% of personal income, a little above the national average of 9.7%.

State tax receipts for the general fund in 1999 came to slightly more than $5.6 billion, compared to $8.48 billion in 2002.

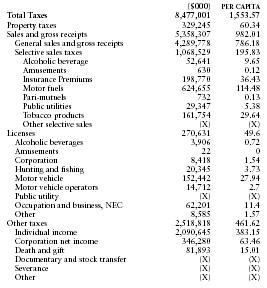

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 8,477,001 | 1,553.57 |

| Property taxes | 329,245 | 60.34 |

| Sales and gross receipts | 5,358,307 | 982.01 |

| General sales and gross receipts | 4,289,778 | 786.18 |

| Selective sales taxes | 1,068,529 | 195.83 |

| Alcoholic beverage | 52,641 | 9.65 |

| Amusements | 630 | 0.12 |

| Insurance Premiums | 198,770 | 36.43 |

| Motor fuels | 624,655 | 114.48 |

| Pari-mutuels | 732 | 0.13 |

| Public utilities | 29,347 | 5.38 |

| Tobacco products | 161,754 | 29.64 |

| Other selective sales | (X) | (X) |

| Licenses | 270,631 | 49.6 |

| Alcoholic beverages | 3,906 | 0.72 |

| Amusements | 22 | 0 |

| Corporation | 8,418 | 1.54 |

| Hunting and fishing | 20,345 | 3.73 |

| Motor vehicle | 152,442 | 27.94 |

| Motor vehicle operators | 14,712 | 2.7 |

| Public utility | (X) | (X) |

| Occupation and business, NEC | 62,201 | 11.4 |

| Other | 8,585 | 1.57 |

| Other taxes | 2,518,818 | 461.62 |

| Individual income | 2,090,645 | 383.15 |

| Corporation net income | 346,280 | 63.46 |

| Death and gift | 81,893 | 15.01 |

| Documentary and stock transfer | (X) | (X) |

| Severance | (X) | (X) |

| Other | (X) | (X) |